The Reserve Bank of India (RBI) has extended the deadline to March 15, 2024, for Paytm Payments Bank Limited (PBBL) to stop accepting deposits, any credit, or any top-up requests in any customer accounts, prepaid instruments, wallets, FASTags, etc.

Now, Paytm has entered into an arrangement with Axis Bank to shift Paytm’s nodal accounts from PBBL to Axis Bank.

Paytm has clarified in a stock exchange filing dated February 16, 2024 that they have shifted nodal accounts to Axis Bank by opening an escrow account. This arrangement will help run Paytm QR, Soundbox, and card machines beyond the RBI-mandated deadline of March 15, 2024.

“This step will help us continue seamless merchant settlements as before. This arrangement is expected to seamlessly replace the nodal account that one97 Communications Limited (OCL) was using with Paytm Payments Bank,” said Paytm in the stock exchange filing.

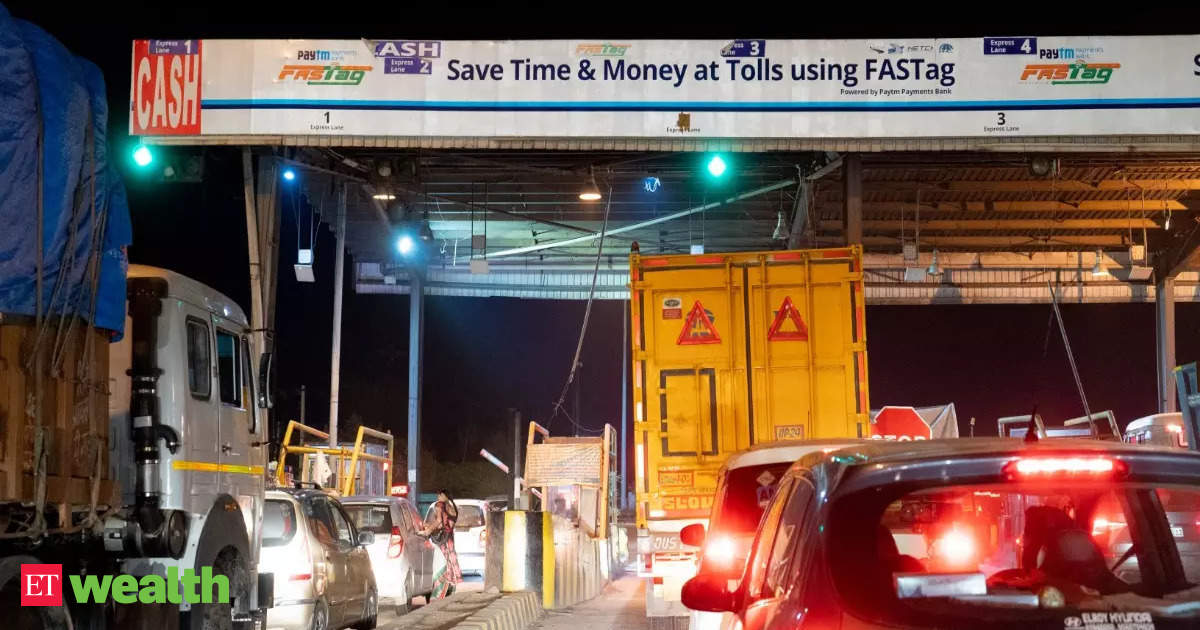

However, Paytm FASTag users will not benefit from this decision.

Will Paytm FASTags would not work post-March 15, 2024?

Although Paytm FASTags can be used post March 15, 2024 however it cannot be recharged. Hence in totality after March 15, 2024 unless otherwise prescribed the usefulness of Paytm FASTag for paying highway toll tax would be nil. “The customers can continue to use the FASTag upto the available balance. However, no further funding or top-ups will be allowed in the FASTags issued by Paytm Payments Bank Limited (PBBL) after March 15, 2024,” says Mukesh Chand, Senior Counsel, Economic Laws Practice, a law firm.The RBI has said that recharge of Paytm FASTag will not be possible post-March 15, 2024. According to a frequently asked question (FAQ) by the Reserve Bank of India (RBI), “After March 15, 2024, you will not be able to top-up or recharge your FASTag issued by Paytm Payments Bank. It is suggested that you procure a new FASTag issued by another bank before March 15, 2024, to avoid any inconvenience.”The RBI also mentions that the credit balance in your Paytm FASTag cannot be transferred to another FASTag. “Therefore, you will have to close your old FASTag issued by Paytm Payments Bank and request the bank for a refund,” said the RBI in a FAQ. This is because FASTags are not currently interoperable.

“The facility of interoperability of FASTag is not available and the customer will have to utilise the Paytm FASTag amount and after that they need to procure a new FASTag issued by another bank,” says Chand.

What do you need to do if you have a Paytm FASTag?

In a frequently asked questions (FAQs) about FASTag, Indian Highway Management Company Limited (IHMCL) said that to enhance the efficiency of the electronic toll collection system, NHAI has taken ‘One Vehicle, One FASTag’ initiative. This move aims to discourage the usage of a single FASTag for multiple vehicles or linking multiple FASTags to a particular vehicle.

“All the FASTags linked to a single vehicle except the latest one shall be deactivated. Acquiring multiple FASTags for a single vehicle is not permitted,” says IHMCL in a FAQ.

So, Paytm FASTag users will have to deactivate it and apply for another FASTag by March 15, 2024, unless otherwise prescribed by the RBI.

“No further deposits or credit transactions or top-ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, National Common Mobility Cards, etc. after March 15, 2024, other than any interest, cashbacks, sweep in from partner banks or refunds which may be credited anytime. Withdrawal or utilisation of balances by its customers from their accounts including savings bank accounts, current accounts, prepaid instruments, FASTags, National Common Mobility Cards, etc. are to be permitted without any restrictions, up to their available balance,” said the RBI in a press release dated February 16, 2024.