I am 45 years old and earn Rs 1.5 lakh a month, after tax. I have a Rs 1 crore portfolio of mutual funds and fixed deposits, and a self-owned house without any loans. I have a corporate health plan, which can be extended after retirement. My current monthly expenses are Rs 50,000 and I want to retire at 60. How can I generate a regular income of around `1 lakh per month after retirement?

Naveen Kukreja, Co-Founder & CEO, Paisabazaar:

Your existing portfolio of Rs 1 crore places you in a comfortable position to earn Rs 1 lakh a month after retirement. You should split your portfolio between equity mutual funds and fixed income instruments in 4:1 ratio. Assuming 10% annualised returns, your portfolio should grow to about Rs 4.17 crore by the time you reach 60. Distribute your equity portfolio equally among flexi-cap, large-cap and aggressive hybrid fund categories, through SIPs, over the next 12-18 months. You can consider the direct plans of PGIM India Flexi Cap Fund and Parag Parikh Flexi Cap Fund for the flexi-cap category; ICICI Prudential S&P BSE Sensex Index Fund and HDFC Index Fund S&P BSE Sensex Plan for the large-cap index category; and Kotak Equity Hybrid Fund and ICICI Prudential Equity and Debt Fund for the aggressive hybrid category. For fixed income instruments, you can invest Rs 1.5 lakh a year in the PPF from your incremental savings. Also invest your incremental monthly surplus in 4:1 ratio in equity mutual funds and fixed income instruments as mentioned above for a bigger post-retirement corpus. As you approach retirement, maintain at least 50% of your portfolio in high-yield fixed deposits with a monthly payout option. A post-tax return of 6% should be adequate to generate the specified postretirement income, while maintaining additional buffers for inflation and cyclical downturns. You should also ensure adequate life and health insurance for yourself. Buy a term insurance policy with a cover of Rs 2.5-3 crore. Though you have corporate health insurance, make sure the cover size is at least Rs 1 crore, with a base health plan of Rs 5 lakh and a super top-up cover of `95 lakh. You can purchase a super topup plan from Niva Bupa or Aditya Birla to avail of a large cover at a low premium.

I am 40 years old and get a monthly salary of Rs 1.25 lakh. I have about Rs 20 lakh in the PPF and am planning to use a part of this corpus for my wedding this year. I have around Rs 4 lakh in small-cap mutual funds. I want to take a family floater health plan. I also have term insurance of Rs 75 lakh. I recently stopped superannuation and plan to withdraw Rs 13 lakh. I have a home loan liability of Rs 16 lakh. What should be my retirement strategy?

Kurian Jose, CEO, Tata Pension Management: We agree with your decision to take a family floater health plan, and suggest you increase your term insurance to Rs 1 crore. You should avoid withdrawal from the PPF as it is a tax-efficient instrument. For a reasonable retirement corpus, you should move your superannuation funds to the National Pension System (NPS), instead of withdrawing it, to avoid tax. You can also start saving 10% of your basic salary in the NPS through your company HR, which will help you claim tax deduction of up to Rs 7.5 lakh a year. For meeting other goals, such as children’s education and house purchase, confine your expenses to 70% of your take-home salary, with home loan EMIs comprising 40-50% of this outgo. Invest the rest in mutual funds.

I am a 32-year-old single woman. I have a Rs 3,000 SIP in an equity hybrid mutual fund, and a Rs 4,000 SIP in a capital builder value fund. My portfolio is worth Rs 10 lakh. I also have Rs 5 lakh in stocks, besides investing in the NPS and PPF. How much will I need to invest to get Rs 1 lakh per month as pension?

Vidya Bala, Co-founder, Primeinvestor.in:

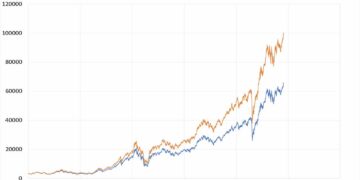

We are assuming you are looking at an income of Rs 1 lakh per month after 60. Instead of an arbitrary number, use an online calculator to see if this amount will be adequate. For instance, if your monthly expenses are Rs 50,000 and existing corpus is Rs 15 lakh (based on the amount mentioned by you), you can assume a high average inflation of, say, 6%. We assume your current investments can earn an average10% over the long term and, after retirement, safer investments in fixed income at 6.5%. Assuming a life span of 80 years, your monthly requirement, after taking inflation into account, would be Rs 2.55 lakh when you retire at 60. Hence, you will need a retirement corpus of Rs 5.8 crore. If you save Rs 20,000 per month, you should be able to reach your goal.

Ask our experts

Have a question for the experts? etwealth@timesgroup.com

Source Link