The Reserve Bank of India (RBI) has announced the final redemption price of the first ever tranche of the Sovereign Gold Bond (SGB). SGB 2015-I tranche is due for redemption on November 30, 2023.

Sovereign Gold Bonds: What are the tax implications?

The first SGB was released on November 30, 2015. In accordance with the terms of the arrangement, the bonds must be repaid eight years after they are issued. As a result, on November 30, 2023, the first tranche of SGB will mature.

What is the redemption price of SGB 2015-I

The final redemption amount, which is due on November 30, 2023, is Rs 6132 for each SGB unit. This amount is determined by using the simple average of the closing gold price for the week of November 20–24, 2023.

How to buy Sovereign Gold Bonds (SGB) online through SBI, HDFC Bank, PNB, Canara Bank, ICICI Bank

As per the SGB scheme guidelines, “The redemption price shall be fixed in Indian Rupees on the basis of the previous week’s (Monday – Friday) simple average closing price for gold of 999 purity, published by India Bullion and Jewellers Association (IBJA).”ET Online had earlier reported that when the bonds ultimately maturity on November 30, 2023, investors in this first tranche of SGB are expected to get a fortune. This is due to the fact that the price of gold has more than quadrupled over the past eight years.

What was the issue price, interest rate

It is significant to remember that the initial SGB was purchased for Rs 2,684 per gram of gold. The issue price is less than half of the prevailing price. As per the notification issued by RBI on October 30, 2015, the SGB offered a fixed interest rate of 2.75% per annum on the initial investment amount.

How much is the increase and how much an investor will earn

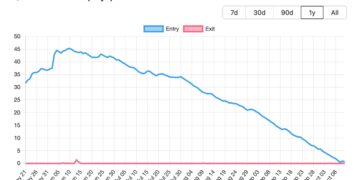

To help you understand the potential returns on your investment in the first SGB issuance upon maturity, here’s an example. Assume that an investor obtained 35 grams of gold during the initial SGB offering. The investment amount is equal to Rs 93,940 because it was made at a cost of Rs 2,684. With a redemption price of Rs 6,132 per gram, the investor will receive Rs 2,14,620.

In absolute terms, an individual will earn a return of 128.5% without taking interest earned on the SGB into account. In CAGR (Compounded annual growth rate) terms, the returns come out to be 10.88%.

SGB details

Every financial year, the RBI announces the issuance of SGB tranches. As of now, an investor is limited to 4 kg per individual each financial year, with a minimum investment of 1 gram. A person must indicate in the application form how much they wish to invest in order to make an investment. The quantity of gold invested is determined by the RBI’s indicated issuance price. The balance amount is refunded to the investor’s bank account.