1/7

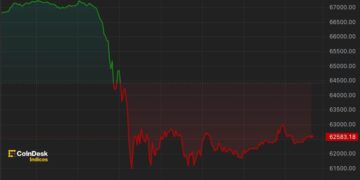

PAN-Aadhaar linkage

From 1st July, 2023, the PAN of taxpayers who have failed to intimate their Aadhaar, as required, shall become inoperative and the consequences during the period that PAN remains inoperative will be as follows:

· No refund shall be made against such PANs;

· Interest shall not be payable on such refund for the period during which PAN remains inoperative; and

· TDS and TCS shall be deducted /collected at higher rate, as provided in the Act.

Getty Images

2/7

Financial transactions that cannot be done with an inoperative PAN

* Opening an account [other than a time-deposit referred at point No. 12 and a Basic Savings Bank Deposit Account] with a banking company or a co-operative bank.

* Making an application for issue of a credit or debit card.

* Opening of a demat account with a depository, participant, custodian of securities or any other person with SEBI

* Payment in cash of an amount exceeding Rs. 50,000 to a hotel or restaurant against bill at any one time.

* Payment of an amount exceeding Rs. 50,000 to a Mutual Fund for purchase of its units.

* Payment of an amount exceeding Rs. 50,000 to the Reserve Bank of India for acquiring bonds issued by it.

* Payment in cash for an amount exceeding Rs. 50,000 during any one day for purchase of bank drafts or pay orders or banker’s cheques from a banking company or a co-operative bank.

Getty Images

3/7

Financial transactions where higher tax will be deducted due to inoperative PAN

· Sale or purchase of a motor vehicle or vehicle other than two wheeled vehicle

· Sale or purchase of any immovable property for an amount exceeding Rs. 10 lakh or valued by stamp valuation authority referred to in section 50C of the Act at an amount exceeding ten lakh rupees.

· Sale or purchase of goods or services of any nature other than those specified above for an amount exceeding Rs. 2 lakh per transaction.

Getty Images

4/7

How many days does it take to activate an inoperative PAN

According to the PIB press release dated March 28, 2023, “The PAN can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of fee of Rs.1,000.”

Getty Images

5/7

How to check if PAN is valid or invalid?

Step 2: Click Verify Your PAN on the e-Filing homepage.

Step 3: On the Verify Your PAN page, enter your PAN, Full Name, Date of Birth and Mobile Number (accessible to you) and click Continue.

Step 4: On the Verification page, enter the 6-digit OTP received on the mobile number entered in Step 3 and click Validate.

Getty Images

6/7

How to check if your PAN is operative using Form 26AS

Step 2: Click on Income Tax Returns under e File tab

Step 3: From the list, click on View Form 26 AS. Confirm on the Disclaimer and mark tick box and click on Proceed

Step 4: Click on View Tax Credit (Form 26AS/Annual Tax Statement)

Step 5: Under Current Status of PAN, you can see if your PAN is Active and Operative

If the status of your PAN is inoperative, it can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of fee of Rs.1,000.

Getty Images

7/7

Higher TDS on dividend income

PAN of the shareholder is either not available or PAN available in records of the Company is invalid / inoperative, tax shall be deducted @ 20% as per section 206AA of the Act.

Note that a valid Permanent Account Number (or “PAN”) will be necessary. In accordance with the requirements of Section 139AA(2) read with Rule 114AAA of the Act and within the specified time frames, shareholders are required to link their Aadhaar with their PAN.

Getty Images