Although gold has historically been the preferred option, silver, referred to as the “poor man’s gold,” is becoming more and more popular as an investment in recent times. Read on to know which are the factors that will determine whether buying silver now (i.e., during Dhanteras and Diwali) will turn out to be a good investment.

The current economic instability is one of the key elements that makes silver an appealing investment in 2023. During times of financial uncertainty, investors frequently shift to precious metals like silver and gold as a safe haven. Silver has a history of holding its value even when other assets, such as equities and bonds, are underperforming.

Demand for silver comes not just from the jewellery sector and consequently its price is influenced by many factors. It has many industrial applications. For example, it is used in sectors such as solar energy, electronics and healthcare among others. Silver also acts as a financial store of value.

How silver performed as an investment in 2022

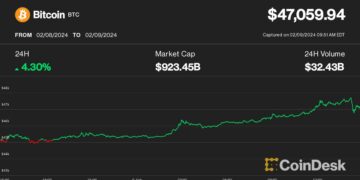

Silver’s value increased steadily in 2022. By the end of 2022, the average price of silver had risen to Rs 86,000 per kilogram, an approximate 35% increase from Rs64,000 at the start of the year. Increased industrial demand and rising interest in precious metals as a hedge against inflation and economic instability are some of the reasons that contributed to this surge.

Historical comparison

One must compare silver with other asset classes to judge potential as an investment in 2023. Silver as an investment has historically proven to be incredibly resilient and has frequently outperformed other assets, particularly during economic instability. For instance, during the 2008 global financial crisis, silver prices surged by almost 440% in a matter of two years, along with the stock market’s catastrophic decline.

Potential of silver as an investment

The following are key factors to keep in mind while assessing silver as a potential investment:

- Industrial Demand: Silver is still in huge demand in the market because of its usage in many high-tech applications, solar panels and healthcare. India’s growing emphasis on solar and renewable energy sources is expected to push up demand for silver for making photovoltaic cells. Silver is an appealing investment option because of continuous industrial demand providing it substantial support.

- Global Economic trends: The demand for and value of silver can be influenced by broader economic trends, including trade dynamics, global economic development, and the strength of the US dollar. A stronger global economy frequently results in more industrial demand for silver and a declining US currency usually drives up the price of precious metals like silver.

- Inflation Hedge: The fact that silver can, depending on the returns from the investment, be a useful inflation hedge is one of the main factors drawing in investors. Silver is a inflation-resistant asset that attracting buying interest due to India’s growing inflation rate.

- Dynamics of Supply and Demand: Silver’s supply and demand dynamics are critical in determining its investment potential. Silver availability has been constrained in recent years due to reduced primary output and decreased scrap recovery. Demand, on the other side, remains strong. This mismatch might cause silver prices to rise.

- Monetary Policy and Interest Rates: Monetary policy and interest rates are very important factors in determining silver’s investment potential. Lower interest rates, which are frequently the outcome of supportive monetary policies, can make non-interest-bearing assets like silver more enticing to investors, thereby increasing demand and prices.

- Market Sentiments: Speculative trading, geopolitical events, economic data releases, media coverage, central bank policies, currency movements, supply and demand dynamics, and investor behavior impact market sentiment in the silver market. Understanding and monitoring these variables is critical for traders and investors navigating the complicated and volatile silver market.

- Silver Supply: A complex interaction of variables influences silver supply, including mining production, recycling, government regulations, technical improvements, and geopolitical challenges. These variables can cause swings in silver supply, affecting market prices. To make educated judgments in the silver market, traders and investors should regularly observe these patterns.

- Gold-Silver Ratio: For precious metal investors and dealers, the gold-silver ratio is a useful instrument. When it deviates from historical norms, it can give insights into market sentiments, assist in influencing investing strategies, and function as a contrarian signal. Understanding the factors that influence the ratio is critical for making educated judgments in the precious metals market.

- Diversification Strategy: Silver can be a good diversifier in your investing portfolio. A well-diversified portfolio can assist in dispersing risk and boost the overall resilience of your assets. The level of interest in diversifying into silver in 2023 may affect its price.

- Risk: It’s important to note that investing in gold and silver carries risk. Prices can be volatile and market conditions can change rapidly. Therefore, it’s advisable to consult a financial advisor and conduct thorough research before making any investments in these precious metals.

In conclusion, silver’s investment potential seems strong as we approach 2024. Silver can be considered for addition to your investment portfolio due to its historical relevance, supply and demand dynamics, investor attractiveness, utility as an inflation hedge, and responsiveness to geopolitical concerns. While it is more volatile than other assets, its distinct characteristics can make it a worthwhile component of a diversified portfolio.

(The author is Certified Financial Planner & Founder at Lets Invest Wisely.)